Mastering the Competitor's Slide: Elevating Your Presentation

The competitive analysis slide is crucial for your presentation. Even more so – this slide can be the most critical in the entire presentation. It will inform potential investors whether your startup stands a chance or not.

If you present minimal competition or none in your presentation, it signals one of two things to investors: either there's no market/demand, or you don't know (or don't want to know) about your competitors. Both scenarios are not in your favor.

Why? Because the absence of competition is not a success but a very alarming sign for investors. Without competition, there's no market. No market means no demand. And if there's no demand, investors won't make money from it.

In the second scenario, when you don't know your competitors or intentionally chose not to analyze them, it signals to investors that you haven't delved into the subject and don't understand where you stand or think too highly or unjustifiably well of your product's uniqueness, or merely didn't bother. In any case, investors won't do your job. They'll label your startup as "raw," underdeveloped, and not investment-ready.

In other words, you must include competitive analysis slides in your presentation and prepare them thoroughly.

First, let's focus on what can RUIN your competitor's slide:

- Superficial and Hasty Analysis of Your Competitors

Here lies the danger of underestimating risks and having an inadequate understanding of the situation, incorrect forecasts, and expectations. It will raise numerous questions, doubts, and even mistrust from investors toward your research and product. Establishing trust is a necessary prerequisite for effective collaboration.

- Informational or Visual Overload or both

Do not overload slides with text or graphics. Avoid using too many different fonts, colors, elements, and callouts. Excessive content can have a staggering and distracting impact on your audience. It significantly complicates perception and communication.

- Discrepancy with the Main Theme of the Presentation

If the information on the slide strays away from the main subject and the purpose of the presentation, it can distract the audience. This distraction diminishes overall interest in the presentation.

- Unfair or Non-transparent Comparison

If the comparison between your company and competitors is not objective or does not consider all aspects, it may raise doubts about your objectivity and the credibility of the information. It may also undermine investors' trust, and further collaboration is unlikely.

- Unclear or Confusing Message, Overly Complicated Formulations

If your message about competitors is not clear enough or written in a complex language, it may lead to misunderstandings and reduce communication effectiveness. Avoid complex terms and overly technical language. Use simple and accessible language for all audience members. If investors don't understand you, you won't reach them.

- Lack of a Problem-Solving Strategy

If the competitor's slide reveals negative aspects regarding competitors but lacks specific plans about how to address or surpass them, it may raise questions and doubts about your capabilities.

And now ten tips on how to IMPROVE your competitive analysis:

Tip 1

Remember that you are preparing the presentation FOR INVESTORS, so think and structure it not from the seller's perspective but from the buyer's perspective – what would be attractive and intriguing for investors.

The investors' goal is to put their money into something and make it grow. For that, they are looking for significant market opportunities to achieve this.

Simply put, the market analysis slide shows precisely where you stand in the complex market landscape and what makes you unique and worth noticing.

Tip 2

Your offer to the investors should clearly explain the size and actual state of the market, as well as the market opportunities specifically for your business.

This is typically categorized as follows:

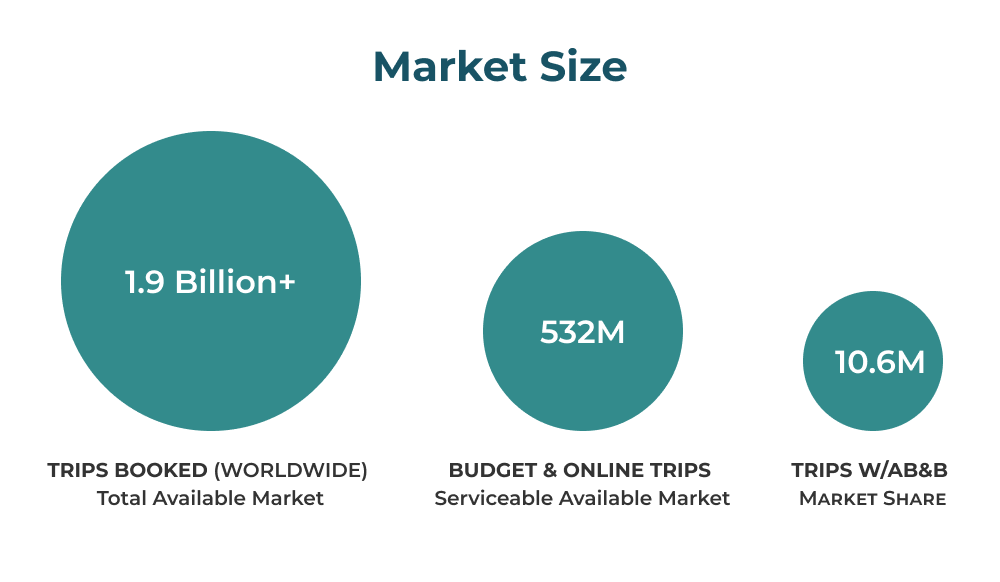

Total addressable market (TAM): This number represents the total value of the sector you're trying to break into. For example, if your product is an innovative baby monitor, your TAM might be all parents of babies under two years old.

Segmented addressable market (SAM): Reflects your target audience — or the segment of the total market most likely to buy your product. Let's say your baby monitor has special features for working parents who leave their child with a babysitter during the day. Then your SAM would be working parents of children under two.

Share of the market (SOM): This is a projection of the share of the available market your company could reasonably capture within a few years and, ultimately, what investors are most interested in.

A great example in the Airbnb presentation:

Tip 3

Your competitive analysis slides should consist of competitors' analysis and market analysis. What's the difference?

Competitor analysis is research aimed at understanding the strengths and weaknesses of competitors in a particular market. It can be especially valuable when figuring out how to position your business in the relevant market and start considering your business and customer needs.

Market analysis. An evaluation of the industry, the purpose of which is to determine if it fits your business. It may involve more quantitative research than qualitative, although it can include both.

You can use the combined information obtained from these forms of research in your presentation to illustrate how you fit into the market and generate profits despite any competition.

Tip 4

When analyzing competitors, remember that there are three types:

Direct competitors. These companies do the same thing as you do, just like you. For example, McDonald's and Burger King, Apple iPhone and Samsung Galaxy, Uber Eats and DoorDash, Airbnb and Booking.com.

Secondary competitors. These are competitors that do the same thing but differently. For example, secondary competitors to car manufacturers like Toyota, Ford, or BMW could be electric bikes, scooters, or public transport manufacturers, which offer alternatives to traditional automobiles.

Indirect competitors. They are companies or products that compete with your company or product indirectly by providing alternative solutions or meeting similar needs of your target audience. They may offer different goods or services but address similar problems or satisfy the same needs. For example, Airbnb, Booking.com, and Expedia are direct competitors, while camping sites, motels, long-term rental apartments, etc., are their indirect competitors.

You need to identify all types of your competitors in your presentation.

Tip 5

Clearly and vividly show investors what sets you apart from your competitors. For this, look at your similarities and differences in various areas before finding a "gap" that can be filled and highlighted. And that will be the reason why someone should choose your product over your competitors' products.

Here are examples of essential tables and diagrams to use during analysis.

Tip 6

In addition to the quality of the collected data, you should know how to present it on a pitch deck slide to have the most desired effect for the audience. There are several practical ways to visualize competitive analysis.

Use diagrams, charts, and matrices. Diagrams and charts are very practical if you aim to highlight certain trends, models, and relationships between the points presented. For example, you can use a pie chart to show segments or advantages of your competitors, while a line chart will indicate the growth or decline of their revenue at a certain point in time.

SWOT analysis: Strengths, Weaknesses, Opportunities, and Threats. It's one of the oldest comparative methods and is still very popular due to its effective and clear representation of fundamental competitors' data.

Competitive positioning map. It is quite easy to create – just build a graph with X and Y axes. Use one of the axes to demonstrate price, from low to high, and the other to determine product quality, again, from low to high. Then put your competitors and yourself on this graph, of course.

Feature comparison tables. It will come in handy if you are looking for the most concise way to present your competitive landscape. This method enables highlighting many noteworthy comparison parameters and characterizing many competitors (in particular, you can predict such a unique parameter that you have and that competitors do not have).

Venn diagram. This overlapping circle diagram shows where competitors have shared or unique features. This design is helpful as it highlights common attributes or market niches and gives a clear understanding of where each competitor fits in the broader market.

Tip 7

Use competitive data to refine your business model. Based on the evaluation, develop your strategy to overcome challenges. The weaknesses of your competitors are your strengths. They are your opportunity to fill the gaps and make a statement. Show investors that you understand the threats and strengths of your competitors and have a clear idea of how to emerge as the winner.

Tip 8

Offer solutions in advance. A detailed analysis of competitors ensures that you can answer potential investors' questions before they ask them. Offer solutions to fill gaps, and don't shy away from difficulties or potential challenges you may face on the path to success. Startups that act proactively in the face of possible threats guarantee potential investors their competence and reliability.

Tip 9

Your presentation slide on competitive advantages should be as clear, consistent, and concise as possible. You will provide more details orally while presenting this slide. Do not overload with information! At the same time, don't be afraid of numbers. For investors, they often speak louder than words. But these numbers should always be fresh (current) and reliable (verified from a credible source).

Tip 10

Craft a narrative according to your competitive advantage. Dry data analysis serves an informative function, but it is the emotional component of your presentation that can push the investor towards a favorable decision and convince them if it evokes empathy. That's why you should try to present a compelling, exciting story from your competitive narrative.

Conclusion

We hope you now feel assured that a comprehensive competitive analysis is an essential component of your startup presentation. A professional competitive analysis pitch deck will help investors understand that you fully understand the threats and challenges posed by your competitors and clearly understand how you are better than them, thus not wasting investors' time.

The Competitor's Slide is not just a visual representation – it is a strategic tool that communicates your unique value proposition, strengths, and positioning in the market. It's a dynamic narrative that convinces others and propels you forward. Create it carefully, align it with your story, and watch how it convinces investors that you are the best.

And SmithySoft is always here to help you with this!