Understanding Unit Economics: A Critical Metric for Startup Success

You need to know about Unit Economics regardless of whether you are a CFO of a powerful and well-known company or just an early-stage startup. After all, understanding unit economics gives you an insight into the viability and profitability of your business, and helps you decide whether to scale your business.

Everyone knows that to stay afloat, every startup must be profitable, i.e., your business’s revenue must be higher than all the expenses you invest in. How do you figure it out? The most effective way is to conduct the unit economics calculation. We will help you figure it out.

What is Unit Economics?

The basis of unit economics for early-stage startups is determining whether you are making a profit or breaking even after you have sold a unit of product and incurred all the costs associated with that sale.

So Unit Economics describes the revenues and expenses of a particular business measured per unit. A unit can be any element that can be quantified and that adds value to the business.

Obviously, “units” are different for different companies. For example, for an airline, a unit can be one ticket sold, for a taxi company, it can be each ride completed, for SaaS companies, it can be each customer, for retailers, it can be a specific product, something you sell.

Importance of Tracking Unit Economics for Startup

- Unit economics can help you forecast your profits. Thanks to the benefits of unit economics, which provide a basic, detailed view of your profits on a per-unit basis, you can determine your profit margin for each “unit” sold much easier. Not only will this help determine how profitable your current business model is, but also when it will reach profitability.

- Startup unit economics can help you optimize your product. You will see whether your product is over- or underpriced. You can also justify or adjust any marketing costs associated with the “units” you sell.

- Understanding your margins at an early stage is important because it will help you forecast revenue growth in the long term and ensure profitability, which is essential for any new business that is just starting out.

- Regularly analyzing your direct revenue and expenses is an important part of understanding how well your business is performing. For startups, it helps identify growth opportunities and also deals with the problems that arise from scaling too quickly.

- Unit economics is a useful measure of the changes you can make to your marketing strategy or budget, pricing model, etc. that can impact sales and save you from diminishing returns.

How to calculate Unit Economics

There are two main ways to calculate unit economics; the key differentiator is defining the unit.

Method #1

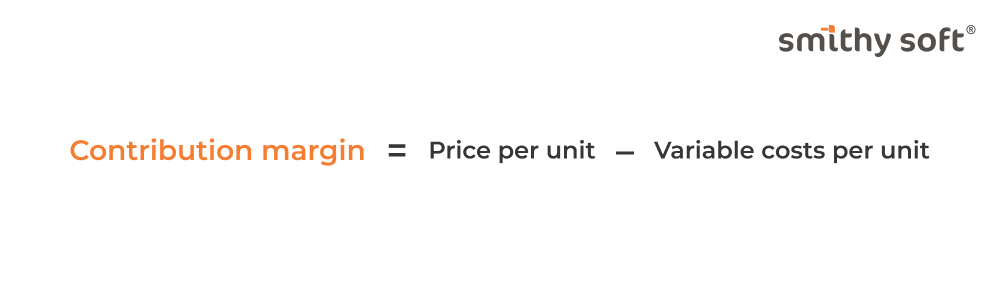

If you define a single product sold as a unit, then the unit economics becomes a calculation of what is commonly referred to as contribution margin. Contribution margin is a ratio based on the revenue your business generates from a single sale minus the cost of the sale. The formula here is as follows:

The higher the contribution margin, the better because it means that your company has more money to cover fixed costs.

Method #2

If you define one customer as a unit, then the economics of a unit is determined by the ratio of two different indicators:

- lifetime value (LTV) – how much money a company receives from a particular customer before the customer stops working with the company;

- сustomer acquisition cost (CAC) – the cost of attracting one customer.

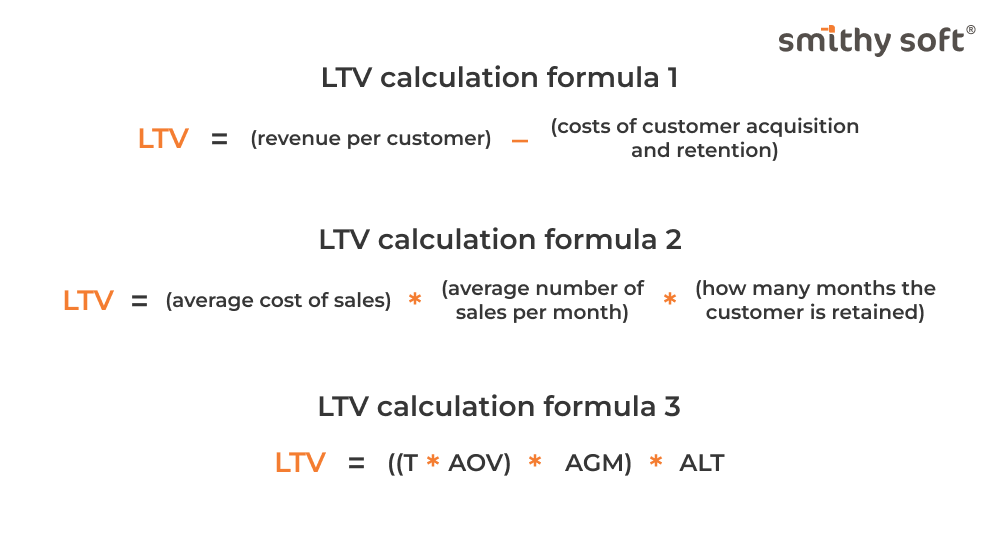

There are several ways to calculate LTV. The more complicated the formula, the closer to reality the result is, because there is less error.

*where T is the average number of sales (orders) per month;

AOV – the average check (average order value);

AGM is the share of profit in revenue;

ALT is the average duration of customer interaction with the company (in months).

САС is the customer acquisition cost. This is the amount of money that one new customer costs a business.

The traditional formula for calculating CAC:

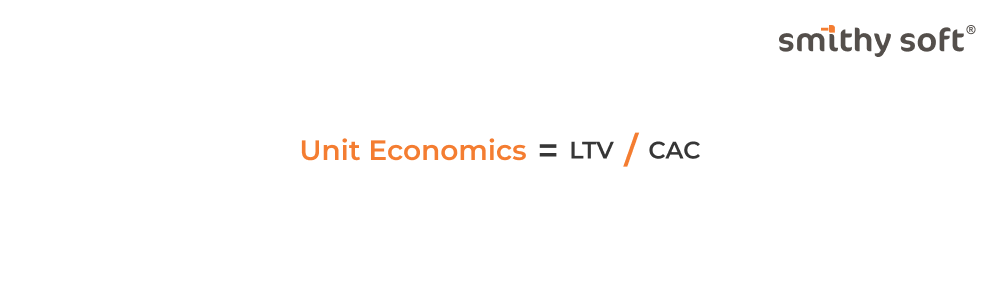

So, in method #2, if we define a unit as one customer, the calculation formula will be as follows:

This indicator is conventionally called customer quality, i.e. how profitable a customer is for the business financially. For every successful business, CAC should be less than LTV. If your LTV does not exceed your CAC, your business quickly burns money. If your LTV is equal to your CAC, you are approaching stagnation. This is still dangerous for a business, as you lack additional revenue to expand your business and scale up.

Example

You want to sell courses online. It costs $450 to make a video lesson for one course. You can sell one course for $20. For an e-learning site, an average of 30 paying students per course. Your variable costs are $15 per student. You get a gross profit of $5 on each sale. To get one paying student, you need to spend $5. Students buy an average of three courses. Thus, your CAC is $5 and your LTV is $5 x 3= $15.

Since your LTV is triple your CAC, investors are likely to invest in your online educational platform.

What does the customer acquisition cost (CAC) include?

The sum of all costs associated with customer acquisition, including:

- marketing expenses: advertising, public relations, and sales promotion expenses;

- sales expenses: salaries, commissions, and other remuneration for employees involved in the sales process;

- technology expenses: software and hardware used to attract customers;

- fixed expenses: rent, insurance, fixed salaries or employee benefits, utilities, payroll taxes, office supplies, etc.;

- variable expenses: the cost of raw materials for production, packaging costs, shipping costs, depreciation of equipment for use, etc.

CAC is often calculated based on the total customer acquisition cost for a certain period (for example, a month) divided by the number of customers acquired.

How to calculate customer lifetime value (LTV)

LTV can be calculated in different ways depending on the business model:

- For subscription services, multiply the average MRR per user by the average customer lifetime.

- For e-commerce businesses: it is the average order value multiplied by the average purchase frequency.

- For enterprise software companies: it’s the sum of annual revenue multiplied by the customer’s lifetime value.

Note that the LTV calculation requires using historical data. It is based on average spending habits, order frequency, and other factors related to customer engagement with the product.

When calculating LTV, it is also necessary to assess other microeconomic factors, such as churn rate and discount rates.

The churn rate is an indicator used to estimate the number of customers who leave the company at any given time. It is calculated as the number of customers lost divided by the total number of customers in a given period (e.g., a month).

Unit economics can help businesses determine pricing strategies by considering discount rates – the rates by which customers receive discounts on their purchases.

CONCLUSION

A startup is only as successful as its unit economics.

Throughout a company's life, its unit economics will inevitably change due to economic conditions, competitive pressures, or other life circumstances. It is essential to keep track of these changes, regularly analyze your Unit Economics to react to the changes in time, and optimize the business model depending on the startup’s capabilities.

If you need professional development or support for your startup, we are ready to help. Don’t hesitate to contact us!