Zero-based budgeting – a breath of fresh air for companies in unstable times?

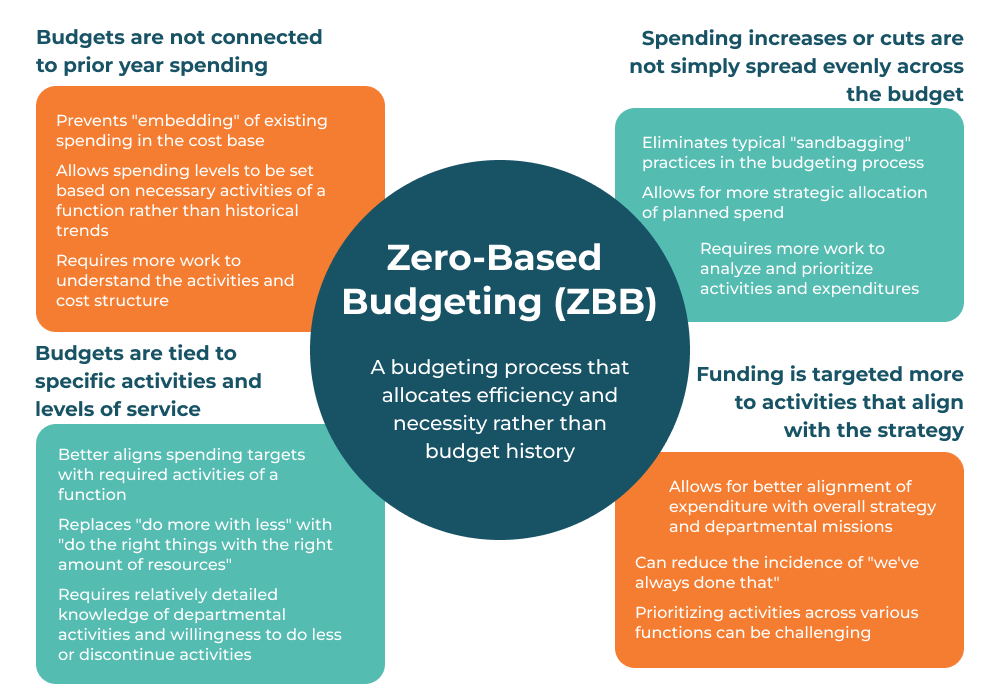

Companies often shy away from this method because they fear it or think it means “starting from scratch.” Zero Based Budgeting (ZBB) is a structured process that can create a culture of cost management.

Faced with high inflation and an uncertain outlook, financial managers are increasingly forced to use tools to reduce costs in the areas of operations, real estate, logistics, sales, and marketing. And this is where a long-known but effective method of saving money for companies enters the arena – zero-based budgeting (ZBB).

Although this technique has been known for half a century, it is now actively used by large companies. For example, General Motors Co., Guess Inc., Honeywell International Inc., Philip Morris International Inc., Coty Inc., Unilever PLC, and many others have used ZBB during the pandemic to cut costs and prepare for possible long-term changes in business travel and other areas of expenditure.

ZBB VS traditional budgeting

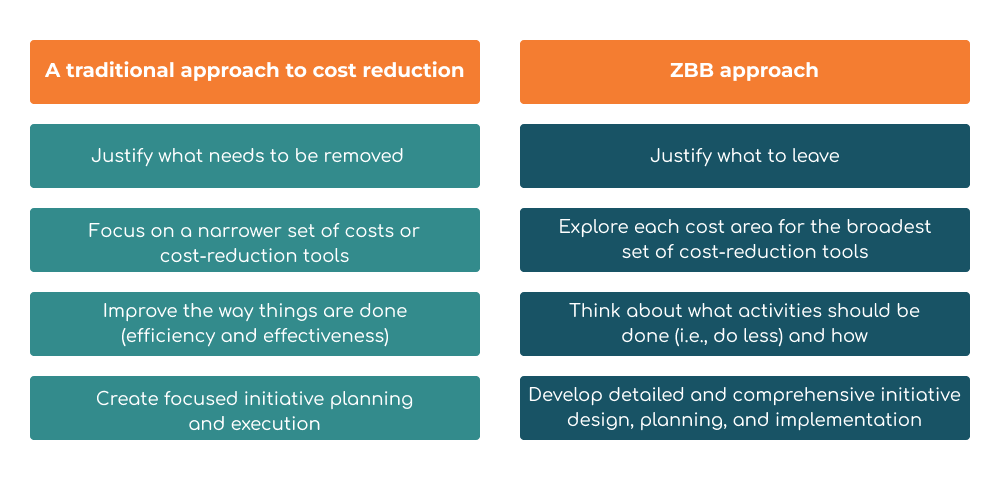

ZBB’s cost management strategy requires CFOs to review and justify each item in their budget from the bottom up. Here they plan the annual budget as if they were starting from scratch, justifying every step and every expense for the reporting period. This approach differs from more traditional methods of budgeting, which involve adjusting the previous year’s spending and reducing ceiling budget amounts by a fixed percentage based on economic forecasts.

Zero, or “clean” budgeting, allows you to cut costs “surgically”. For example, reduce real estate space as employees increasingly work remotely and customers switch to online shopping.

Advantages

Allows cost levels to be set based on the function’s required performance rather than historical trends.

Allows to increase business profitability due to cost savings and alignment of costs with strategic goals.

Improves productivity and operational efficiency by validating assumptions and analyzing costs.

Managers think about how every dollar is spent while focusing on operations that generate the most revenue. Collaboration between all managers and planners for the common goal of cost budgeting focused on meeting business needs.

Emphasis on doing the right thing most cost-effectively. This activity can provide a low-risk approach to cost-based transformation, leaving companies adequately resourced and well-funded for future growth.

Disadvantages

The main disadvantage is the laboriousness of planning, which takes a lot of time because everything is “from scratch”: a new budget is developed for each period, so the time spent may be unjustified.

Can be prohibitively expensive (due to the time, research and analysis required) for companies with minimal available funding.

May harm the overall company culture or brand image.

The main focus of ZBB is short-term prospects and current challenges. Therefore, areas such as research and development, or those with a long-term horizon, may be left out.

The success of ZBB depends on having a detailed understanding of operational cost drivers such as activity volumes, productivity ratios, and input costs – none of which are contained in traditional planning and budgeting software.

Five steps of zero budgeting

Start: Make everything from scratch. Create a new annual budget from scratch without using last year’s actuals as a baseline.

Evaluation: estimate each cost area. Eliminate and reduce unnecessary activities or services.

Justification: record all the components of the budget. Identify relevant and cost-effective areas.

Optimization: Determine what actions should be performed and how. Automate and standardize processes where possible.

Execution: Deploy comprehensive planning and execution processes. Communicate clear plans, roles, and responsibilities for employees.

So, is ZBB the solution or a waste of time?

Implementing zero-based budgeting is not just an accounting decision and should be considered in conjunction with the company’s overall business strategy and goals. It must be understood that while a zero budget can help companies cut costs better, it can completely change a company’s value and culture.

The fact that zero budgeting creates budgets from scratch every year can be a great advantage for companies, especially in times of instability, economic downturns, and crises. If, for example, processes are inefficient or sales growth in recent years has not met expectations, this method can bring a breath of fresh air to the company.

By challenging the budgets of each department, ideas for innovation have more room. Even if it makes planning more time-consuming, it can provide important information and insights that can positively affect the company’s success and correct the situation.

You can apply zero budgeting once and revert to traditional budgeting after redefining budgets. This process can be repeated every three to five years. This way, you get the best of both worlds: the efficiency gains from zero budgeting and the less time-consuming planning of a traditional approach.